Code your Capital, Configure your Flow

The Future of Lending Is Programmable

We’re building LINC Money one use case at a time. Not to fix the old system. But to create the next one.

- Lending that’s embedded into business operations

- Risk that’s engineered, not estimated

- Capital that’s fluid, responsive, and contextual

We’re creating the rails for a new kind of liquidity —

One that flows when and where it’s needed most.

Features

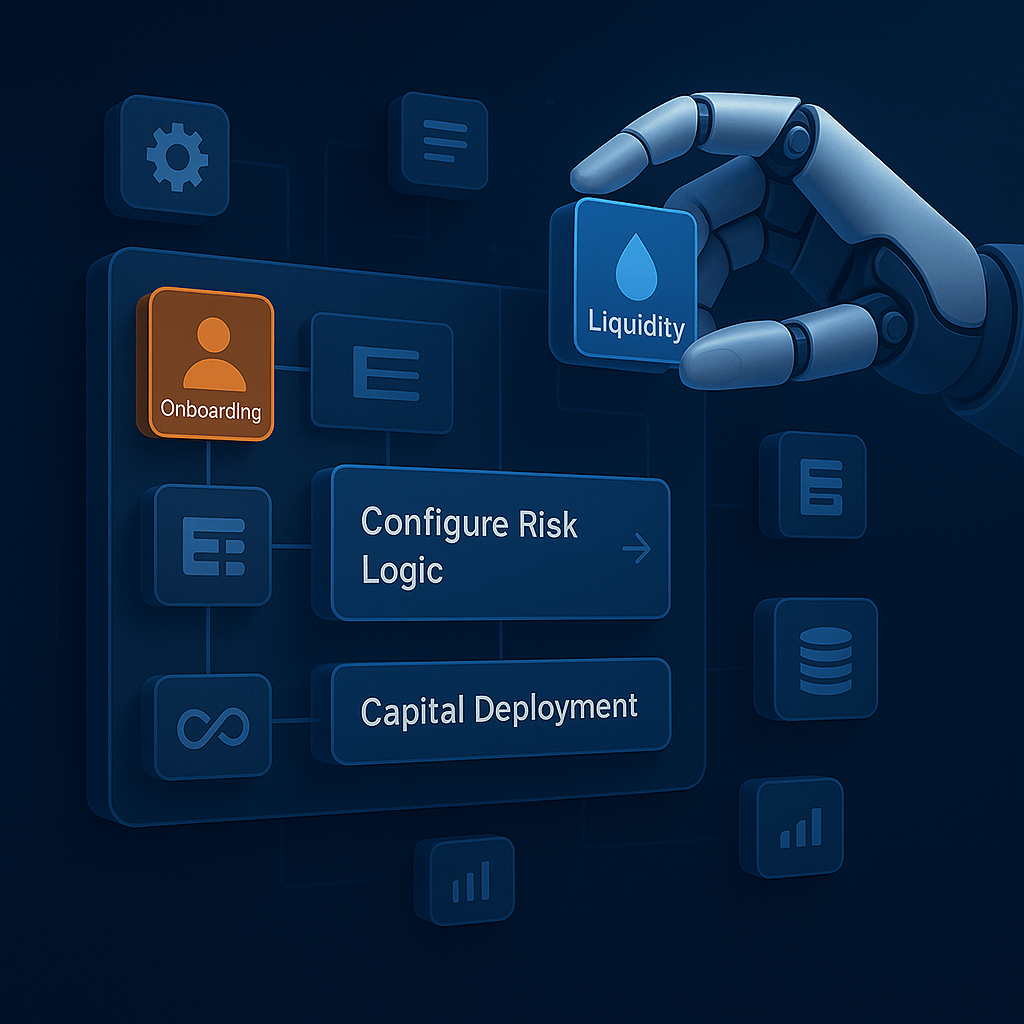

Fast, frictionless onboarding experience

Borrowers and investors can onboard seamlessly with automated KYC/AML, guided UX, and smart document uploads—all built for speed and compliance.

Data-driven underwriting & decisioning

We leverage behavioral, financial, and alternative data to evaluate borrower risk—offering faster, fairer, and more accurate lending decisions.

Real-time risk & portfolio analytics

Investors and platform admins access dashboards with detailed performance metrics, historical returns, borrower behavior, and collateral health in real time.

Smart matchmaking & fund allocation

Requests are matched with investor criteria using a proprietary logic that balances risk, return, and diversification preferences—fully or partially funded.

Collateral-backed lending framework

Each funding request is underpinned by digital or physical collateral, reducing default risk and increasing investor trust.

Modular lending pools & tranches

Investors can fund entire requests or participate in diversified pools, with risk-return tiers managed through structured tranching.

Multi-industry lending use cases

The platform supports flexible funding across sectors—from gig economy and retail to supply chain and asset-backed businesses.

API-ready for Partners & Platforms

Lending modules, risk engines, and data flows are available via API—ideal for embedding into banks, marketplaces, or fintech apps.

Privacy-first, compliant infrastructure

Platform built to align with GDPR, CCPA, KYC/AML, and financial regulations in every deployment region.

We’re rebuilding how finance flows

At LINC Money, we believe lending should work like the rest of business: responsive, intelligent, and data-led. More importantly, lending should not be a function on its own but intertwined in the business directly where it is needed the most. But today’s credit system is designed for anything but this. Capital is expensive. Risk models are outdated. And banks have pulled back just when businesses need them most. We’re here to change that.

How? By making lending programmable

LINC Money turns live business data into programmable financial assets. We make it easy for lenders to build, customise, and automate lending workflows — from onboarding and decisioning to risk scoring and capital deployment. All tailored to how your business sees risk, values collateral, and manages liquidity. Think of it as an intelligent toolkit — like configuring your ideal workspace from an IKEA showroom — only for finance.

This is just the beginning

Not just faster. Smarter. Embedded. Built for the way business actually works.

CONTACT USHow is this product different?

Built for the data-rich world we already live in. Every business is sitting on a wealth of trade data — transactions, subscriptions, sales, payments. We ingest your data properties in real time and transform it into live assets that are:

- Auditable

- Tradeable

- Risk-aware

- Investor-aligned

How do you automate lending flows?

Capital orchestration, not just credit automation. Whether you're a lender, an investor, or a platform embedding finance, LINC Money gives you programmable control:

- Configure your own credit rules

- Align multiple investor strategies for deployment

- Monitor risk and performance dynamically

- Embed lending directly into B2B workflows

Why now?

The market is ready — but the tools aren’t.

- Private credit is exploding: Up 400% in Europe over the past decade

- Banks are retreating: They now underwrite less than 30% of corporate debt

- SMEs are going digital: AI and data adoption are growing rapidly

- Short-term finance is broken: Traditional overdraft facilities are gone, and what’s left doesn’t scale